47+ statute of limitations on second mortgage debt

Web The Statute of Limitations and Mortgages. Secured loans for personal.

New York Court Of Appeals May Settle Statute Of Limitations Issues Related To Mortgage Foreclosures Consumer Financial Services Law Monitor

Web The Statute of Limitations on Mortgage Debt is the time limit allowed for the creditor to bring legal action against the debtor for the total debt amount.

. Typically it lasts between three and six years in most states though a few states have a longer time. Web Statutes of limitations are laws that govern the deadlines on certain legal actions. Web The statute of limitations on debt is the length of time that debt collectors have to sue you to collect old debts.

Web In some states the statute of limitations for foreclosure is six years which is based on the right to enforce a promissory note under the Uniform Commercial Code UCC. Private student loans not government-backed loans. Web Most statutes of limitations fall in the three-to-six year range although in some jurisdictions they may extend for longer depending on the type of debt.

Web Up to 25 cash back The statute of limitations bars creditors from suing for unpaid debts after a specific amount of time. If you have old unpaid debts you might be safe from lawsuits. As you may have noticed the statute of limitations is almost never 7 years.

Web The statute of limitations does not erase the debt. It simply makes it unenforceable by the courts. How long a creditor or debt collector has to take legal action against you varies depending on the.

But dont be mistakenyou arent off the hook for a debt just because the. If you use the statute as a reason for not paying that could. In many places the statute of limitations is.

Web Yes each state has its own statute of limitations on debt. Web The statute of limitations is the period of time when a creditor or debt collector can file a lawsuit against you to recoup the money you owe. Web The four-year statute of limitations also applies to the following types of debts.

This means there may be circumstances where a debt is time-barred but still on. Web The second mortgage statute of limitations varies by state. Generally the statute of limitation is 10 years from the last date of payment on a loan secured by a mortgage and 6 years from the last date.

The key periods provided by the Statute of Limitations 1957 the Statute are. Sale 12 years from when the right of. Web Posted on Sep 23 2015.

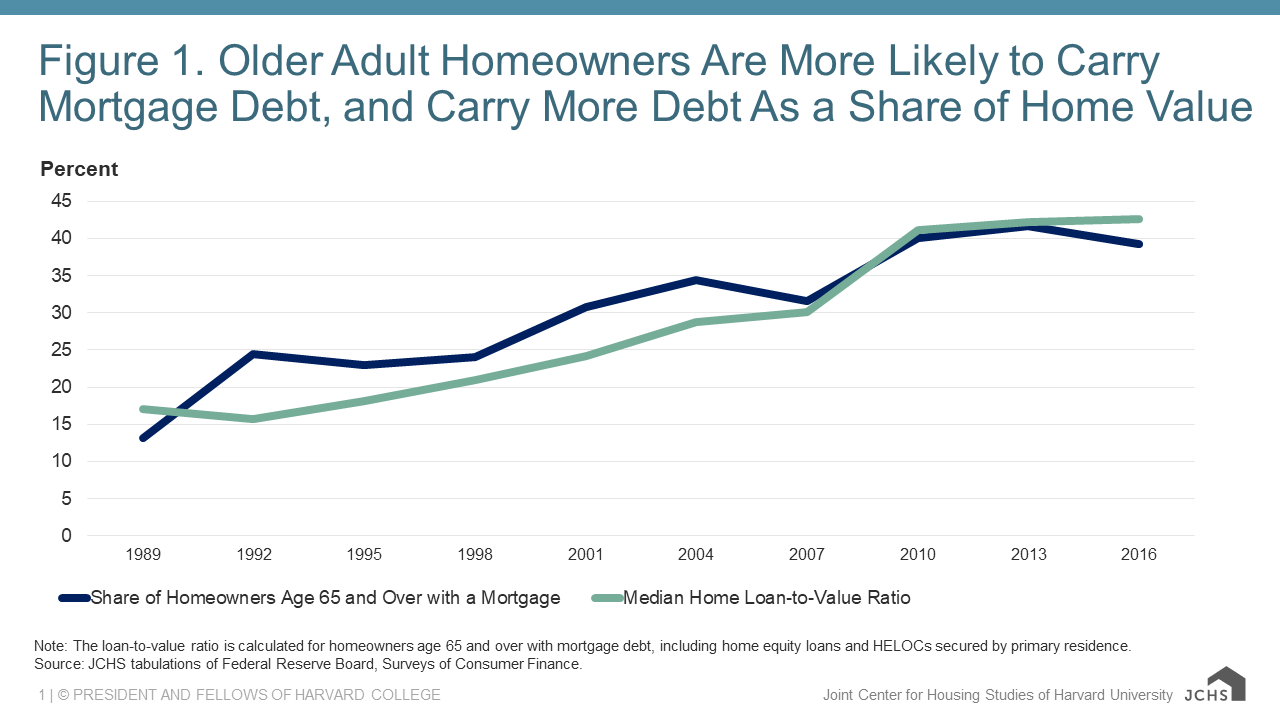

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

Mapping Out Average Mortgage Debt Across The U S

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

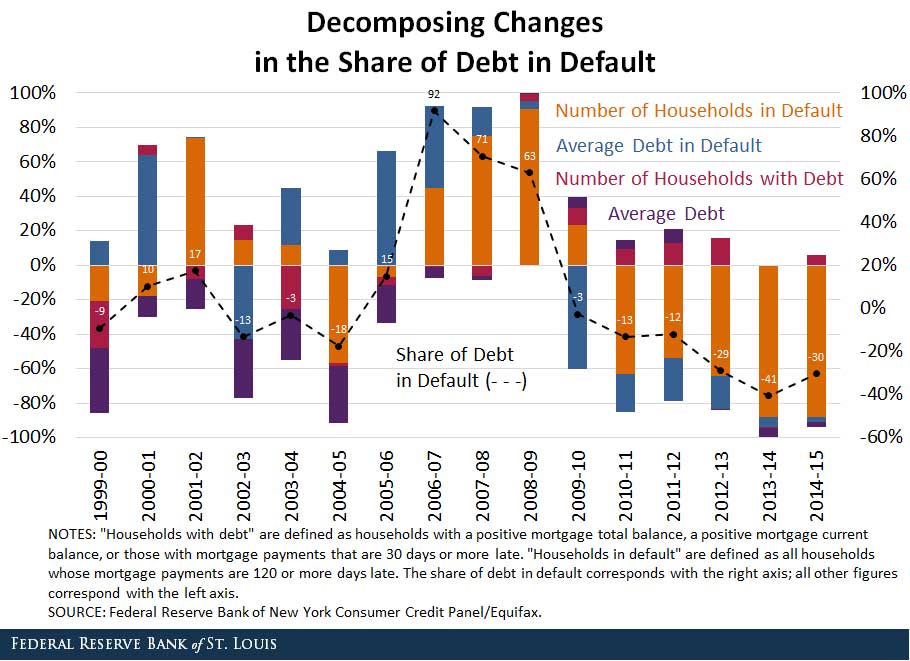

Why Has The Share Of Mortgage Debt In Default Fallen

9th Cir Holds Mortgagee S Sold Out Second Claim Not Barred By California S 4 Year Statute Of Limitations The Cfs Blog

Is There A Statute Of Limitations For A 2nd Mortgage Lien That Is Charged Off And Discharged Via Chapter 7 Legal Answers Avvo

U S Mortgage Debt Hits A Record 15 8 Trillion Housingwire

What Is Statute Of Limitations Regarding 2nd Lien Mortgage Debt From Original Loan Legal Answers Avvo

Free 10 Debt Letter Samples In Ms Word Pages Google Docs Ms Outlook Pdf

Environmental Law Pdf

Zombie Debt Homeowners Face Foreclosure On Old Mortgages Maryland Daily Record

The Ins And Outs Of Mortgage Debt During The Housing Boom And Bust Sciencedirect

9th Cir Holds Mortgagee S Sold Out Second Claim Not Barred By California S 4 Year Statute Of Limitations The Cfs Blog

Second Mortgage Wikipedia

America S Mortgage Debt Spiral Accelerates To All Time High

Free 10 Debt Letter Samples In Ms Word Pages Google Docs Ms Outlook Pdf